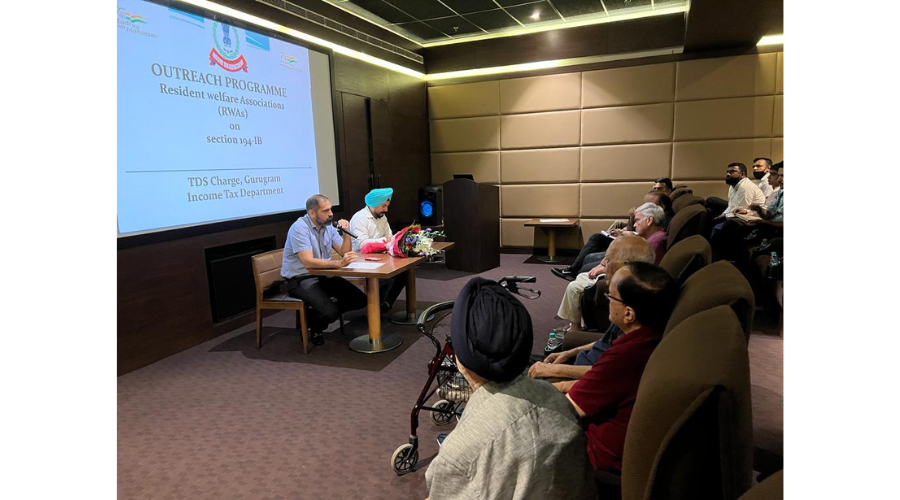

An outreach program was conducted under the on ongoing celebration of Azadi ka Amrit mahotsav by the TDS Department of Income Tax Gurugram. It was presided over by Additional Commissioner of Income Tax (TDS) Gurugram Sh. Vikas Singh IRS and Deputy Commissioner of Income Tax (TDS) Sh. Arjun Singh. The program, was conducted at the Club of The Vilas Condominium Association, Akashneem Marg, Sector 25, DLF Phase 2, Gurugram Haryana. Office Bearers and residents and landlords from around 15 RWA’s of Gurugram were invited. The seminar was well attended. The TDS department explained the provisions of section 194IB which relates to deduction of TDS on payment of rent on house property by individuals and HUF’s on monthly rent of Rs. 50000 or more per month. It was explained that the liability to deduct TDS is on the tenant when the tenant is is a individual or HUF and the rent is more than Rs. 50,000/- per month. The rate of TDS is 5%. The tenant is liable to deduct TDS once during the financial year which is at the end of the financial year or end of the tenancy period whichever is earlier. The tenant does not require to take a TAN number and the deduction and deposition of tax is based on the PAN number and a pan based form 26QC is required to be filed by the deductee. The payment of TDS is required to be made once in a year and the TDS so deducted has to be deposited to the credit of Central government with 30 days of the end of the month in which the TDS is deducted. The tenant has to issue a certificate of deduction of Tax in form 16C within 15 days from the deposition of the tax. The TDS will reflect in the Pan Number of the landlord. The non deduction of TDS by tenant attracts penal provisions which are 1% for non deduction of TDS and 1.5% for non deposition of TDS after deducting and Rs 100 per day for delay in filing the form 26QC. After the explanation of the section, various questions were raised by the persons attending the seminar which were replied by the Additional Commissioner TDS and Deputy Commissioner of Income Tax TDS Gurugram. The participants were appreciative of the outreach program and were pleasantly surprised at the initiative of the department in explaining the releavnt provisions. The meeting ended with thanks to the TDS department of Income tax and the organizers of the program.

Gurugram Income Tax officers organised seminar to aware about Section 194-IB

Facebook Comments Box